Experience unmatched ACA compliance service and support with our ACA Complete® solution. We deliver everything you need to track, prepare, furnish, file, and defend your ACA compliance. Our market-leading, comprehensive solution includes:

Know exactly when offers of coverage are required for both state and federal filings through our meticulous ACA tracking service.

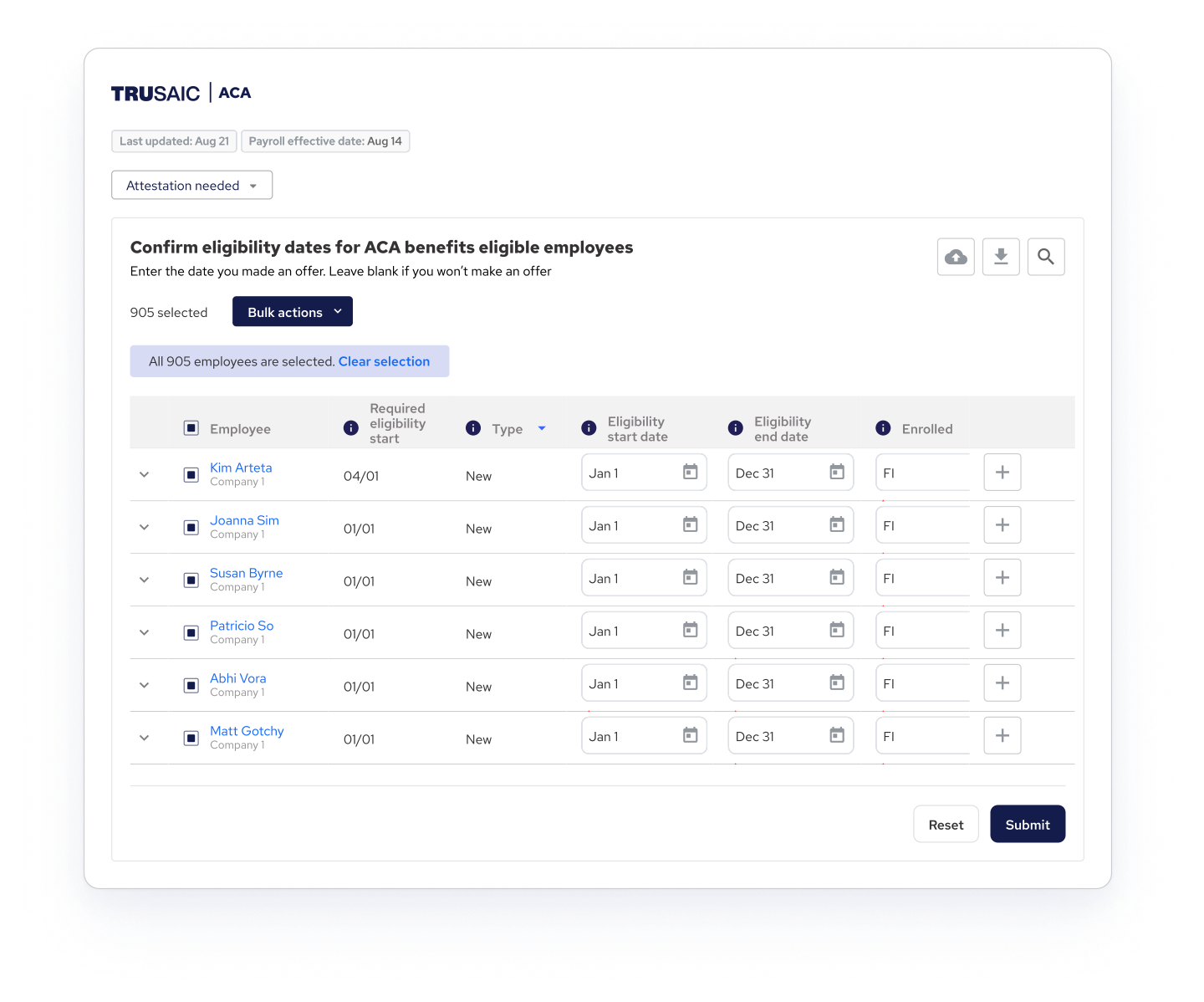

We prepare and distribute your required 1094-C/1095-C forms to employees.

An expert designated ACA specialist manages the entire compliance process for you.

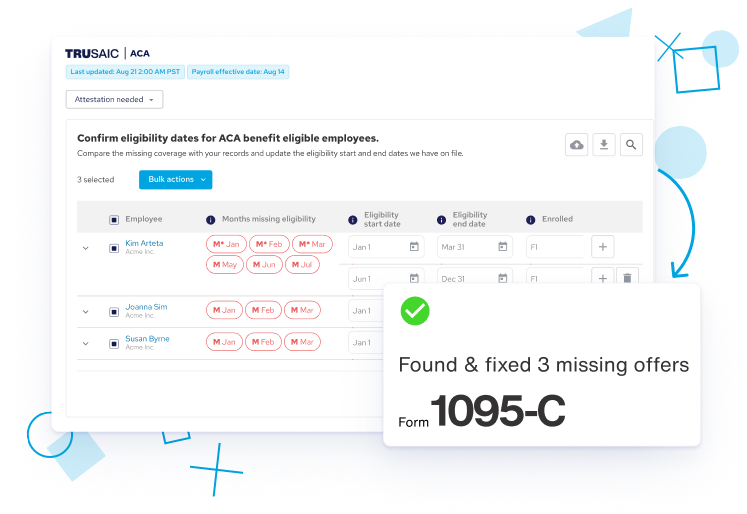

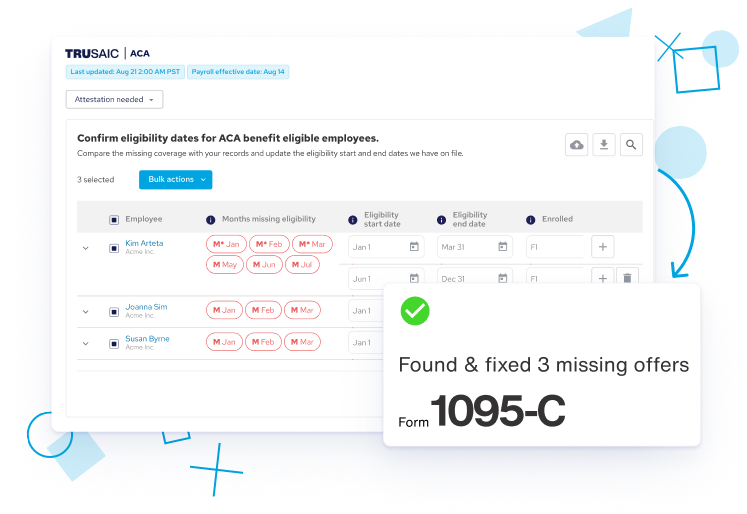

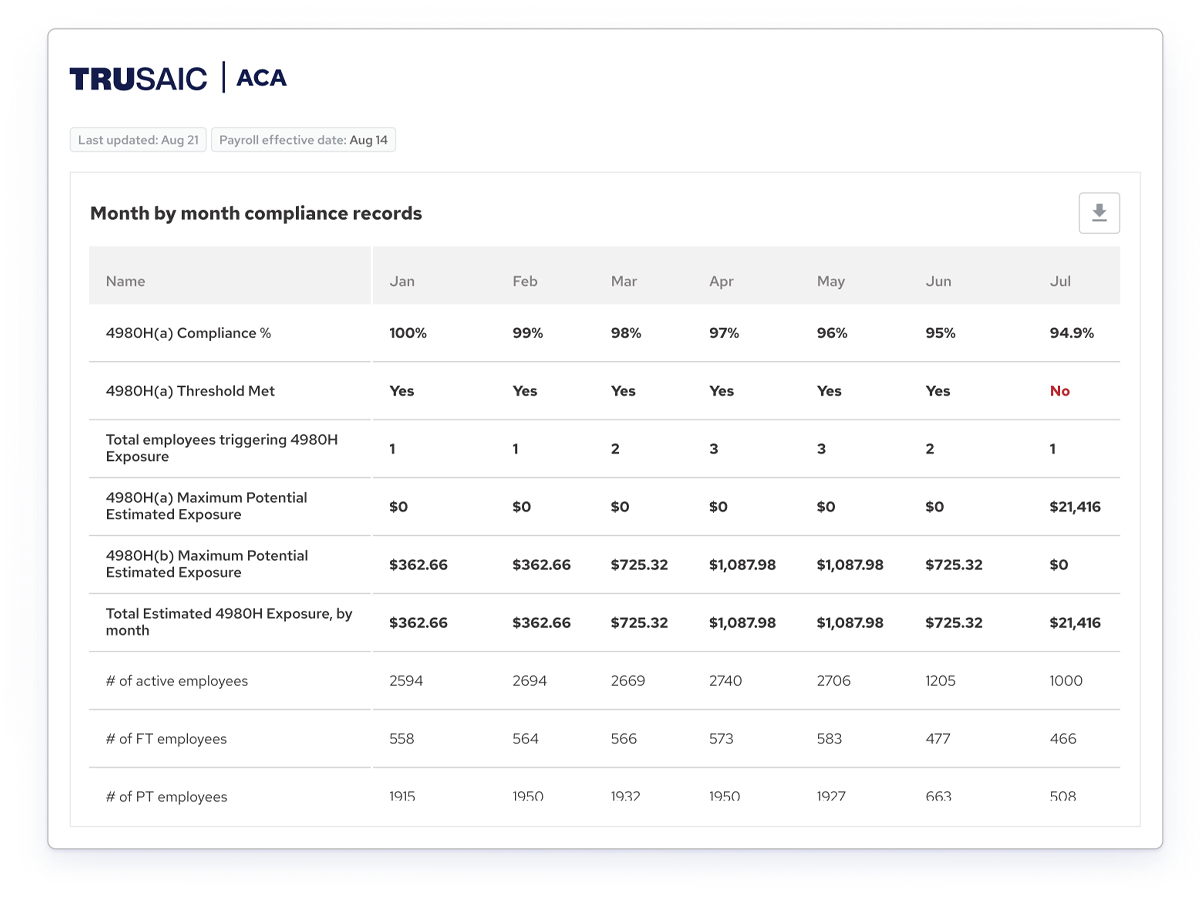

Our software quickly analyzes all of your pertinent HRIS data and identifies where you have gaps in ACA coverage and liabilities.

Our solution is powered by certified data integrations with the world's largest HCM, HR and Payroll platforms, including Workday, SAP, UKG, and ADP.

We minimize your IRS penalty risk and, in the event of an IRS or state audit, rest assured, as we will provide a comprehensive ACA audit defense for your business. To date, we've prevented more than $1 billion in IRS penalties with our services.

Our technology solves the people and process failures that drive penalties, many of which are created by disjointed, inaccurate, or incomplete data.

From multiple data sources, we consolidate, clean, and transform your data into accurate, actionable intelligence. Clean data, combined with our regulatory expertise, provides the basis for all of our ACA solutions.

Ready to experience elevated ACA compliance?

ACA furnishing deadlines are strict and consistently enforced. Failure to comply with IRS filing deadlines for 1095-C, or furnishing incorrect forms, will result in significant penalties for your organization.

Our designated support team prepares and distributes your 1095-C forms on-time to applicable employees by U.S. mail or electronically.

ACA compliance doesn't stop at the federal level. Many jurisdictions, including California, New Jersey, Rhode Island, and Washington D.C. have mandated state reporting for ACA.

If you are an employer with operations in any of those jurisdictions, add state filing to your ACA compliance efforts to:

The IRS is becoming increasingly more aggressive in its Affordable Care Act enforcement efforts. There are a myriad of penalties employers can be assessed for non-compliance.

Receiving one of these letters can feel overwhelming, and stalled action is an incredible risk that can result in significant penalties. Timing is of the essence when you receive an IRS penalty letter.

Since employers were first required to comply with the ACA's Employer Mandate in 2015, we've helped our clients save over $1 billion in ACA penalty assessments.

This is what we do. Let us handle it for you.

Reduce or eliminate your IRS penalty assessments.

Reduce or eliminate your IRS penalty assessments.

We respond to the following IRS letters:

Failure to file notices and follow up letters

Incorrect filing notices

226J, M, K, L, 227J (937 with 227J enclosure)

Annual reporting + monthly monitoring + audit defense

Forms preparation and filing with expert support

1094-C/1095-C IRS and state 1 filing

1095-C print and mail 1

Penalty Risk Assessment

1095-C review and approval

Expert support for annual filing

Annual reporting + monthly monitoring + audit defense

Compliance tracking, filing, and a designated ACA

specialist for risk mitigation

1094-C/1095-C IRS and state 1 filing

1095-C print and mail 1

Penalty Risk Assessment

1095-C review and approval

Designated ACA specialist

Health plan compliance review

ACA process consulting review

IRS controlled group analysis

Establish IRS measurements and periods

HR data configuration, monthly data consolidation and data quality analysis

Monthly metrics, compliance tracking and documentation management

IRS affordability and health insurance overspend monitoring

Exchange notice appeals

Comprehensive IRS audit defense 1

ACA compliance doesn't stop at the federal level. Many jurisdictions, including California, New Jersey, Rhode Island, and Washington D.C. have mandated state ACA reporting.

Add state filing to:

State filing ACA services are available in three ways:

ACA compliance doesn't stop at the federal level. Many jurisdictions, including California, New Jersey, Rhode Island, and Washington D.C. have mandated state ACA reporting.

Add state filing to:

State filing ACA services are available in three ways:

Fast and secure data retrieval is key for ensuring ACA compliance. ACA Complete software integrates seamlessly with leading global human resource information systems (HRIS) and Trusaic partners Workday, SAP, UKG and ADP.

Gain complete visibility across your ACA compliance, filing, and reporting efforts for free.

Gain complete visibility across your ACA compliance, filing, and reporting efforts for free.

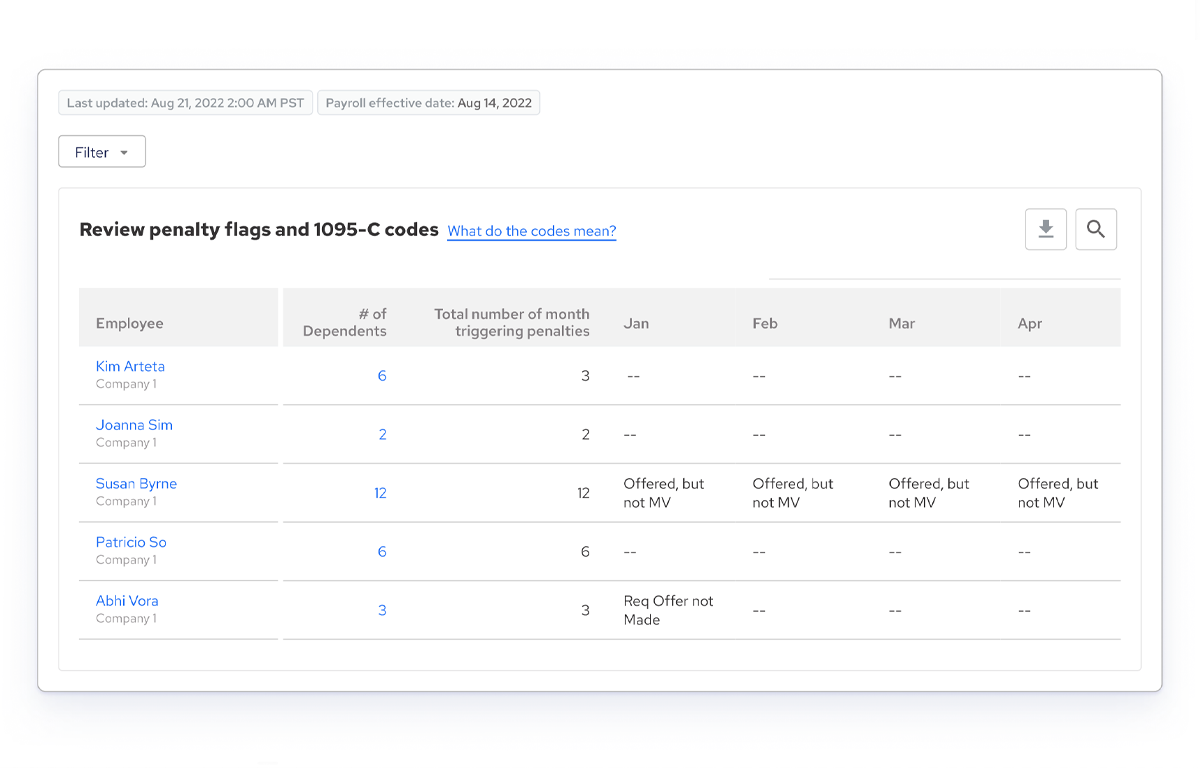

Data discrepancy

Mismatches in the information you provided in your 1094-C template compared with what we calculated based on the 1095-C template

Risk of over-reporting

Number of employees for whom a Form 1095-C is not required based on the code combinations you entered in your 1095-C template

Coding errors

Number of employees triggering code combination errors based on the information you provided in your 1095-C template

Compliance errors

Number of employees with Section 4980H compliance issues. Common issues include no offer of coverage and affordability

Total penalty exposure

Total 4980H(a), 4980H(b), 6721, and 6722 penalty exposure estimated based on your templates

1. Additional fees apply

Trusaic's unique combination of data analytics, human expertise in regulatory compliance, and ongoing monthly tracking and penalty risk assessment gives companies the confidence they need to ensure their ACA compliance is done right.

We offer a free penalty risk assessment that provides comprehensive analysis of your potential exposure.

Yes, we offer unlimited expert support with annual filing for ACA Essential.

Yes, we can perform a retroactive audit of your HR data and create a penalty letter response for you, while in parallel developing ongoing ACA tracking to prevent future penalty letters.

Yes, you can add state filing for an additional fee to ACA Essential.

If an employer has at least 50 full-time employees, including full-time equivalent employees, on average during the prior year, the employer is an Applicable Large Employer (ALE) for the current calendar year, and is therefore subject to the Employer Shared Responsibility Provisions (also referred to as the ACA Employer Mandate) and the Employer Information Reporting Provisions, which requires ALEs to report annually to the IRS information about the health care coverage, if any, they offered to full-time employees. The IRS will use this information to administer ACA penalties for non-compliance.

Under the ACA, an Applicable Large Employer (ALE) member may either offer affordable Minimum Essential Coverage that provides Minimum Value to its full-time employees (and their dependents) or potentially owe an Employer Shared Responsibility Payment to the IRS. An employer-sponsored plan provides Minimum Value if it covers at least 60 percent of the total allowed cost of benefits that are expected to be incurred under the health care plan offered to full-time employees.